In 2024, U.S. businesses reported $12.5 billion in fraud losses, up from $10 billion the prior year—a 25% year-over-year increase, according to The Silicon Review.

As fraud risk continues to escalate across digital channels, a leading financial service provider of private-label credit cards, savings and personal loan products recognized the urgent need for a smarter, more predictive approach to account verification and authentication. With diversified lending portfolios and a growing customer base, the organization partnered with ValidiFI to conduct a data study aimed at tackling their goals of increasing coverage, reducing risk, and boosting approval—benchmarking performance against its current provider.

CHALLENGE:

The company faced several critical pain points that were limiting growth and increasing exposure to fraud:

-

- Existing validation provider verified only 60% of accounts and authenticated only 47%—leading to a high volume of manual fraud reviews

- High rate of inconclusive or missing data

- Limited visibility into account ownership and status

- Missed approvals and increased operational costs due to low confidence in account data

SOLUTION:

The company performed a data study analysis of ValidiFI’s vAccount+ Verify with AOA, a predictive bank account and payment intelligence solution designed to deliver deeper insights across the customer lifecycle. The solution leverages a broad spectrum of data sources and technologies, including:

-

- Historical transaction analysis to verify account status and activity

- AI/ML-powered pattern recognition to extend coverage based on risk tolerance and behavioral signals

- Real-time authentication to confirm whether the individual matches the account owner on file

This multi-layered approach provides a more complete view of account integrity and ownership—supporting smarter, faster, and more confident decisions.

RESULTS:

ValidiFI’s predictive intelligence didn’t just outperform the incumbent—it redefined what’s possible in account verification and authentication. The data study results showcased immediate and meaningful improvements across key performance indicators. From broader coverage to sharper authentication and more confident approvals, the results speak volumes:

-

-

-

+18% increase in account verification coverage

-

+30% increase in authentication coverage

-

88% of verified accounts were also authenticated

-

Accounts with no information were reduced by 30%*

-

ValidiFI was able to validate & authenticate more bank accounts than the incumbent was even able to verify

-

-

*For accounts where ValidiFI provided data that was missed by the existing provider, 73% were major bank and credit union accounts. These were successfully uncovered using ValidiFI’s predictive intelligence, revealing critical blind spots in traditional verification methods.

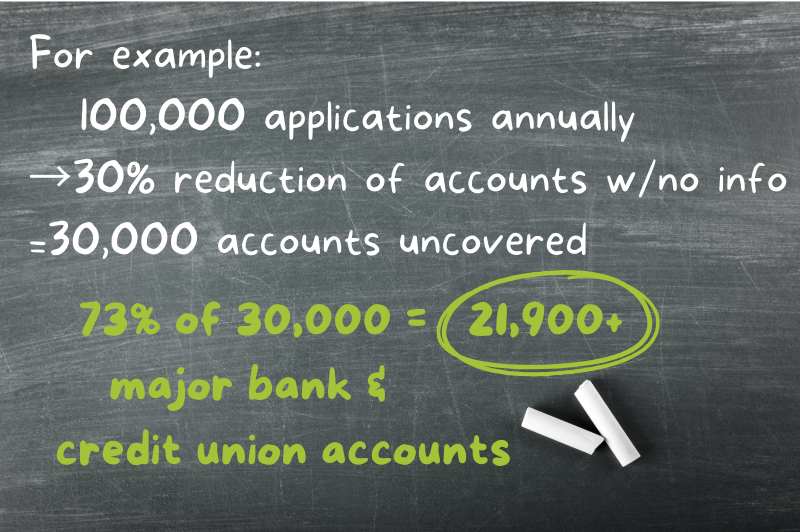

AS AN EXAMPLE:

For a lender processing 100,000 applications annually, accounts with no information could be reduced by 30%, meaning 30,000 previously unverified accounts now have data. Of those, approximately 21,900 are major bank and credit union accounts—many of which may be valid, fundable, and secure.

WHY IT WORKS:

By leveraging ValidiFI’s vAccount+ Verify with AOA—powered by AI-driven pattern recognition, historical transaction analysis, and real-time account intelligence—the company gained deeper insight into both account validity and ownership. But what exactly does that mean in practice?

To understand the full impact, it’s important to distinguish between the critical components of intelligence: each representing a deeper level of trust.

-

- Verification confirms whether a bank account is open, valid, and active.

It answers: Is this account real and usable? - Authentication confirms whether the person or business owns or controls the account.

It answers: Does this account belong to the person claiming it? - Validation combines both with additional context—like behavioral patterns, transaction history, risk signals—to support confident decisions.

It answers: Can I trust this account for the intended transaction?

- Verification confirms whether a bank account is open, valid, and active.

ValidiFI delivers all three—building trust from the ground up and reducing fraud risk with every layer.

“When you combine real-time data with predictive intelligence, you unlock a new level of confidence in every transaction, said ValidiFI CEO John Gordon. “That’s what we’re delivering—and it’s changing how our clients approve, fund, and grow.”

“When you combine real-time data with predictive intelligence, you unlock a new level of confidence in every transaction. That’s what we’re delivering—

and it’s changing how our clients approve, fund, and grow.”

—John Gordon, CEO, ValidiFI

READY TO VALIDIFI YOUR FRAUD STRATEGY AND REVENUE GROWTH?

See the results for yourself via a no-commitment data study tailored to your portfolio.

Contact us to start your data study today.

📊 Read more about our industry impact: ValidiFI’s New Tools Revolutionize Verification

![[OLA Member]](https://validifi.com/wp-content/uploads/2024/06/seal.png)